SafeSend - Secure Returns for Businesses and Individuals

We are happy to help! See the list of questions and answers below, or if you prefer, click here to watch an in depth walk-through video provided by SafeSend. If you do not see your question here, contact us at 1-800- 943-4278 and ask to speak with admin support for assistance. Additionally, you can visit the SafeSend Returns Help Center for afterhours support.

For Businesses, Trust & Non-Profit Returns

Check your spam/junk email folder. You can also search your email for noreply@safesendreturns.com. Some email clients hide items they’ve labeled spam or junk, making certain emails difficult to find. If you do not receive your code within the 10-minute time limit, please request another code.

There is currently no SafeSend Returns app available, but the signature process can be completed on any computer, smartphone or tablet via a web browser.

Yes. If you’re using a smartphone or tablet, you may not be able to download and print your return, but you will be able to review and electronically sign it. Don’t worry — you can always download and print your return from your personal computer at a later date.

If estimated payments are included in your review copy, you will automatically receive an email reminder seven days before your payment is due.

You have the option to electronically distribute or mail hard copies. For electronic distribution, you will need to enter the email address for each corresponding partner. Click here for a full video with instructions.

In some circumstances, you may need to print and mail information to government authorities. Common examples include tax and estimate payment vouchers and local income tax returns. If forms need to be printed and mailed, you will receive clear instructions. You will also be provided options to make tax payments electronically if you prefer not to mail payments.

Individual Returns

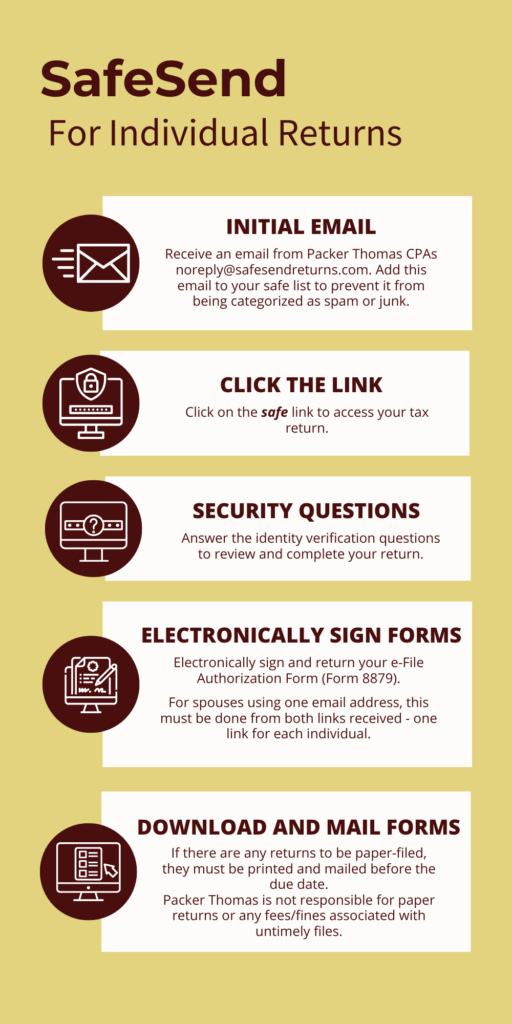

Yes. Email notifications will be sent from Packer Thomas CPAs at noreply@safesendreturns.com. We recommend adding this email address to your safe list to prevent the email from getting filtered to spam/junk.

Yes. SafeSend Returns offers a secure system to view and sign your e-file authorization form(s). Look for HTTPS:// at the beginning of the site URL and a locked padlock symbol in your browser’s URL bar to confirm you are on the secure site.

The questions SafeSend Returns asks are knowledge-based questions pulled from government and credit sources. You may be asked questions such as where you lived in a given year, or when you bought your car or home. In the event the questions do not apply to you, simply choose the answer that accurately reflects this. If you don’t remember the answers to the questions, or you answer incorrectly, you won’t be able to electronically sign your e-file authorization form(s). You can instead print, sign and return your e-file authorization form(s) to Packer Thomas.

SafeSend Returns allows you to electronically sign your individual e-file authorization form(s), but it won’t submit your return to the IRS. Once signed, Packer Thomas is automatically notified, and we will then complete the filing process for you, including submission to the IRS.

For spouses filing jointly, there are three ways to sign via SafeSend Returns:

If both spouses have an email address on file, both will receive an email with a link to view the return and sign the e-file authorization form(s). First, one spouse will receive the link with identity verification questions specific to him or her. He or she will sign the e-file authorization form(s) and input the spouse’s email address, which will send an email link to the second spouse.

The second spouse will answer identity verification questions specific to him or her and then sign the form(s). If only one spouse has an email address on file, that spouse will first receive the link with identity verification questions specific to him or her. He or she will sign the e-file authorization form(s) and then enter an email address for the second spouse. The second spouse will then receive the email link with identity verification questions specific to him/her. Once the second spouse electronically signs the e-file authorization form(s), Packer Thomas CPAs will be notified that signing is complete.

If a couple shares an email address, the primary signer will first receive a link with identity verification questions specific to him or her. After the primary signer signs the e-file authorization form(s), he or she can then enter the shared email address again. A new link will be sent with identity verification questions specific to the second spouse.

Packer Thomas will deliver your dependent’s return using SafeSend Returns. However, some dependents may not have sufficient government and financial data available to successfully complete the electronic signature process. If there is not enough data available, your dependent will be given the option to download and sign their forms.

While an electronic signature is certainly easier and more convenient, you can still print, sign and mail your e file form(s) back to us if you’d prefer to do so.

Yes, once you sign your e-file authorization form(s), you will receive an email stating it was successful. The email will also include a link to download a copy of your tax return for your records.

In some circumstances, you may need to print and mail information to government authorities. Common examples include tax and estimate payment vouchers and local income tax returns. If forms need to be printed and mailed, you will receive clear instructions. You will also be provided options to make tax payments electronically if you prefer not to mail payments.